flow through entity private equity

The double taxation can be avoided using this mechanism. Federal income tax purposes as either a Partnership Trust Qualified or Non-Qualified Intermediary or other non-US.

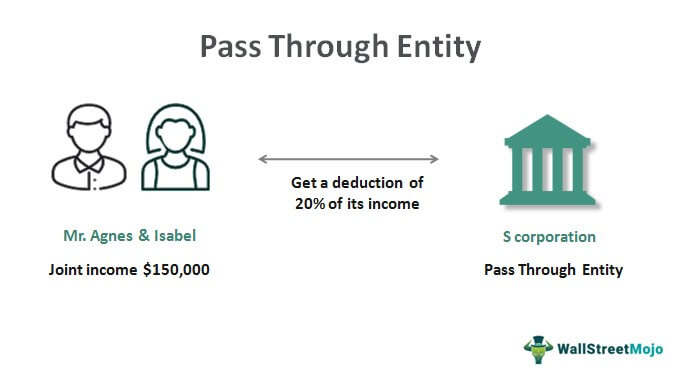

Pass Through Entity Definition Examples Advantages Disadvantages

Trade or business flow-through operating entities.

. PE deals are sourced through various methods such as equity research internal analysis networking cold-calling executives of target companies business meetings screening for certain criteria. A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests. The particular focus of this blog post however is on three potential fund structures that may be used by a private equity fund buyer when acquiring a portfolio company that is partially blocked by a private equity seller.

ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. The income of the owners of flow-through entities are taxed using the ordinary. Investor generally will not.

In an earlier article titled Rollover Equity Transactions 2019 we discussed the various business and tax issues associated with transactions involving private equity PE buyers who include rollovers of target owner equity in their leveraged buyout LBO transactionsHere we take a deeper dive into the ramifications of having some PE investors invest in target. The difference between cash flow splits versus true promotes is a topic that often raises questions for retail investors and for good reason. The most significant benefit of using this mechanism is that the businessman can easily save on their taxes.

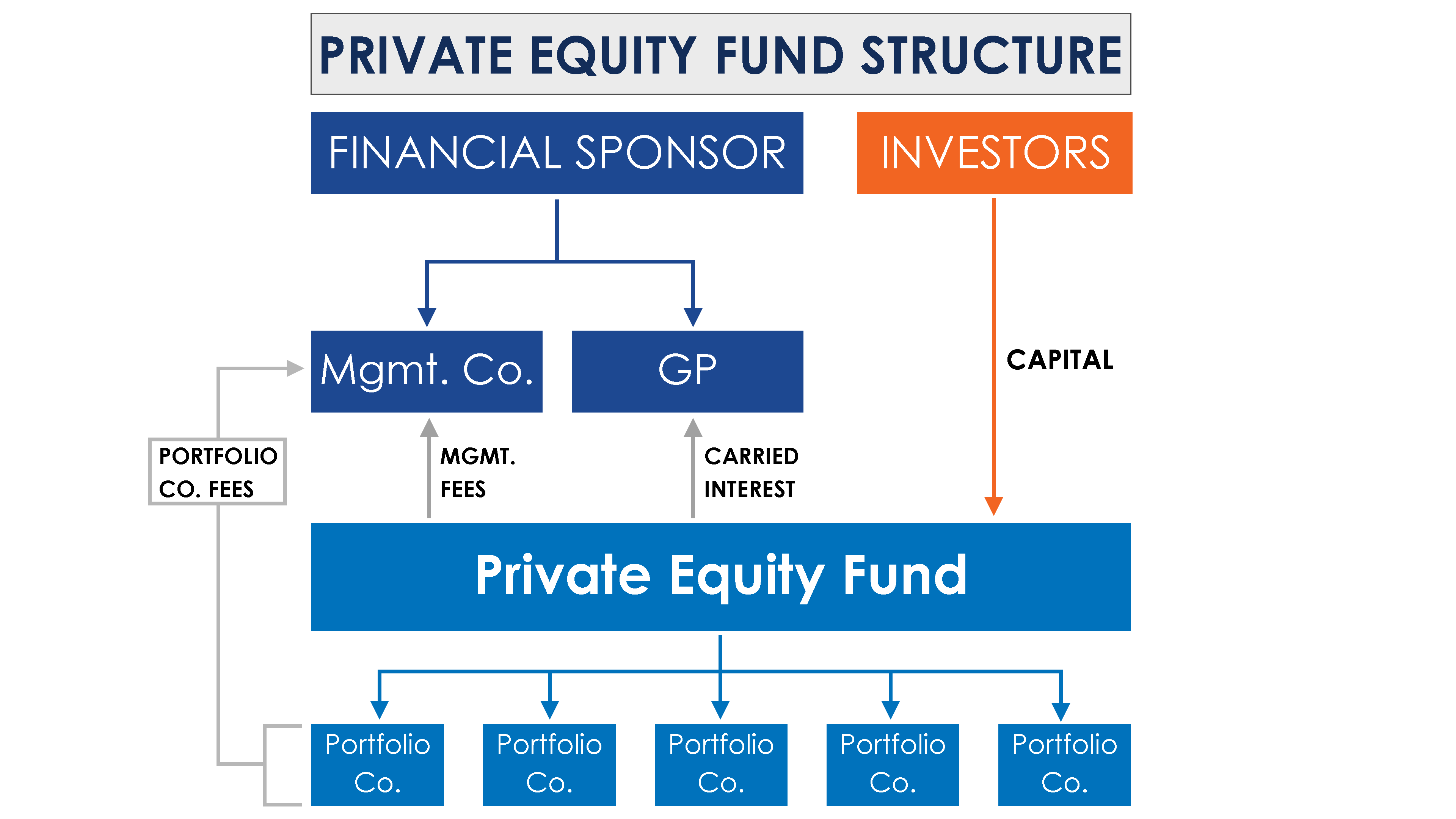

Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities. Owners have to pay takes on their dividend income and also on the. This is generally comprised of a General Partner and a Management Company.

Raising a private equity fund requires two groups of people. The pass-through entity helps the owners of the business to pass their income to them. A flow-through entity is also called a pass-through entity.

The term blocker refers to a corporation that an investor eg. A better way to measure the companys performance by Investment banks Investment Banks Investment banking is a specialized banking stream that facilitates the business entities government and other organizations in generating capital through debts and equity reorganization mergers and acquisition etc. The GP and LP equity are now in distinct entities and the JV LLC Agreement dictates how cash flow is divided between the two entities as well as how control is allocated.

Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities. Most governmental plans take the position that as governmental entities. 1 Financial Sponsor Sponsor in image.

We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow. An entity taxed as a flow-through will generally have greater value because of the significant tax benefits and that can be afforded the purchaser than for. In addition the non-US.

Generally determined at the level of the taxable equity holder of the flow-through entity. The team of individuals that will identify execute and manage investments in privately-held operating businesses. The entity with the legal.

Flow-Through Entities If your institution is organized outside the US and is classified for US. Private equity and hedge funds are generally structured as pass-through entities allowing them to pass their entire tax obligation along to their investors or limited partners. Flow-through entity an original Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

States real property interests USRPIs or interests in flow-through entities themselves engaged in a US. 20 2021 to provide an elective flow-through entity FTE tax. The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the investments under a single aggregating vehicle taxed as a partnership for.

Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals. There are many PEVC funds with limited partners such as pension funds or non. Real Estate Capital Markets REITs.

In these models the taxes pass or flow through directly to the owners rather than the company. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below. Us Income taxes guide 117.

Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. An LLC is a pass-through entity for tax purposes so a private equity fund invests in it. The income of the business entity is the same as the income of the owners or investors.

Pass-through entities also called flow-through entities are business structures used by the vast majority 95 of US. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Companies to avoid double taxation.

Related to Flowthrough Entities. Most of the income of most private equity and venture capital funds will consist of gains from the sale of portfolio. JPE-Spiroindd 12 051119 148 pm RSULJKW 3DJHDQW0HGLD WG.

Sourcing and Teasers The beginning of the private equity deal structure is called deal sourcingSourcing involves discovering and assessing an investment opportunity. Pass-through entities typically include sole proprietorships partnerships limited. Planning devices can include the following.

The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the.

Register Your One Person Company Registration In Kolkata Sole Proprietorship Public Limited Company Company

What Is Private Equity Deal Structure Flow Process Guide

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

Shareholders Vs Stakeholders Accounting And Finance Accounting Education Learn Accounting

Joint Venture Joint Venture Financial Management Financial Strategies

Limitations Of Financial Statements Financial Statement Accounting And Finance Financial Life Hacks

Private Placement Memorandum Template Google Docs Word Apple Pages Template Net Reference Letter Templates Purchase Agreement

Setting Up The New Company Can Often Be Scary Especially If You Never Run A Business Or Company Before We Have Company Corporation Delaware Business Company

Efinancemanagement Com Financial Management Concepts In Layman S Terms Accounting Student Accounting Education Accounting And Finance

Efinancemanagement Com Financial Management Concepts In Layman S Terms Accounting Student Accounting Education Accounting And Finance

Hand Drawn Flow Charts Flow Chart How To Draw Hands Powerpoint Charts

Private Equity Fund Structure A Simple Model

Current Yield Meaning Importance Formula And More Finance Investing Learn Accounting Accounting Basics

Stock Talk New Brand Names For The New Decade 2020 30 Movie Market Brand Names Jet Airways

Projected Balance Sheet Templates Free Balance Sheet Template Balance Sheet Resume Template Examples

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

Private Foundation Organizational Structure Hurwit Associates Organizational Structure Private Foundation Organizational Chart

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning